As people save for retirement, they strive to determine how much they will need to maintain the lifestyle they live. However, saving up for retirement becomes more complicated as time progresses. People buy homes, while at the same time they are paying off student loans or paying for their children’s education. The kids sign up for chess, taekwondo or basketball and there are tournament fees and uniforms to buy. Simple living costs make it hard to save. How does one keep up with retirement savings?

When it comes to retirement savings, time is a valuable asset. Time can make a seemingly small increase in your contributions grow into great savings. However, sometimes it’s difficult to visualize the impact of a small change.

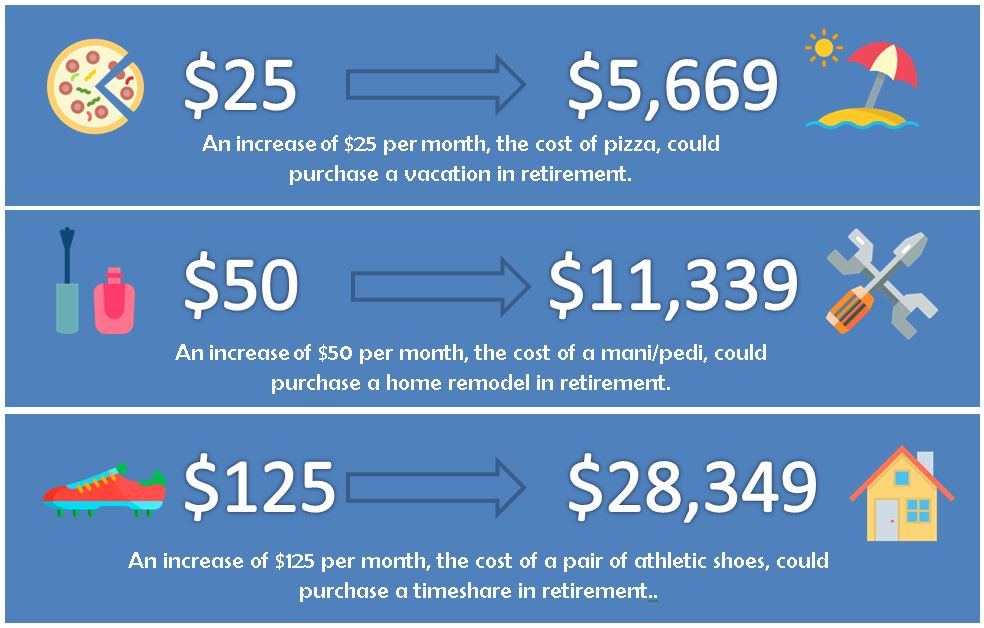

Here are a few examples of retirement contribution increases that could make a significant impact.

Based on monthly contributions for 15 years at 3%. Hypothetical example for illustrative purposes only – not representative of any particular investment.

Just as maintaining a fit lifestyle relies on developing a healthy diet and consistent exercise routine, financial fitness also has a few main components. To secure your financial well-being, it is important to visualize a secure retirement. Be confident in tomorrow: National Life Group can help you protect and grow your retirement savings.

The next component is instilling good financial habits by making small contributions that grow into big savings over time. Finally, you can begin to strengthen your financial plan by contributing a few more dollars each month. Take steps today to make a financially independent tomorrow a reality.

Use this calculator to learn more about the cost of waiting to save.

TC96433(0717)3