I couldn’t imagine a more perfect life for myself other than the life I was currently living.

I had traveled the world as a four-time Olympian. With my soulmate and husband by my side, I marveled at the wonders of life as we raised our three young children to be adventurous, courageous, and strong. I had started a successful career helping others protect their futures.

I couldn’t imagine how much my own life would soon change.

When I had retired from full-time high jump competition, a life of habitual goal-setting quickly led me to become a financial services representative and life insurance agent. Having one-on-one conversations with my family and friends about their aspirations and financial futures was a dream for me. Knowing that I was armed with a toolkit that could help them with their hopes and dreams gave me a sense of purpose.

Educating them on the intricacies of financial planning and policy structuring made me realize that I had to be more than just an informer. I had to also become a consumer of the products and services I presented to my clients. This revelation caused me to become my own first client, purchasing policies for myself and my husband with riders that would provide Living Benefits for certain qualifying situations.

After purchasing the policies, I didn’t think much about them. I was young and healthy, so after reviewing my policies annually, I mentally filed them out of sight and out of mind. I paid my premiums, knowing I had the protection in place but hoping not to need it any time soon.

I grew in the financial services space as the years went by, earning series 7, 63, and 66 licenses. As my ambitions for executing my business plan began to catch steam, I realized I was neglecting my health and self-care. I immediately slowed down and prioritized a healthier lifestyle that included a nutrient-rich diet, exercise, and self-breast exams.

The exams were uneventful for the first couple of years, but at the beginning of the third year of my self-care journey, I found an itty bitty tiny rice-sized lump.

After having it checked by my doctor, biopsied, and diagnosed, I was told the lump was a malignant tumor. Triple-negative breast cancer was the official diagnosis and would require a double mastectomy and months of chemotherapy. I was devastated and terrified.

I’ve heard so many times before that when you go through a life-or-death situation, your life flashes before your eyes.

But it wasn’t my life that flashed before my eyes.

It was the lives of my children and my husband without me.

Reeling from this diagnosis, the only thing I could think to do was go home and cry in the closet. Choosing not to leave my side, my husband stood in the closet with me, helpless against the mighty blow cancer had just dealt our family. Utterly defeated, I looked at him and said, “I’m sorry that I’m gonna leave you here alone and our kids without a mother.” Taking the opposing view to my defeat, he chose to empower me with his words and say, “No, you have been a fighter your entire life, and you are not about to quit now. This is the time to fight.” I devoured his words and decided he was right.

I was going to fight.

My first thoughts of my fight were spent mentally calculating the finances and making sure we could afford to take on the cost of a cancer battle. As I cascaded down my checklist, I rested on the dreaded question we must responsibly ask ourselves if we have people in our lives that we love and care about.

That question is, “God forbid… what if?”

What if this was the end? I was so shocked that the policy that I was content to leave out of sight and pushed to the back of my mind was now at the forefront of my thoughts and screaming at me.

At this moment, my life insurance policy was a life raft keeping me from drowning in the abyss of despair. The answer to the dreaded question of “what if” was that, yes, God Forbid I didn’t outlive this diagnosis, my kids would still go to college, my family wouldn’t lose our home, my husband would not be forced back to work during a time of grieving, and he would be able to afford maintaining a lifestyle that is familiar to our kids. Knowing that my dreams for my family would remain intact gave me an overwhelming peace of mind. I realized all those years ago when I purchased my life insurance policies I was not buying life insurance, but “LOVE insurance.”

The relief and gratefulness rushed over me like a flood, and I began the most important fight of my life. I started researching and learning everything that I could about breast cancer. I learned that 1 in 8 women in the US is projected to be diagnosed with breast cancer in their lifetime. I learned that African American women are 40% more likely to die of this disease than our white woman counterparts, and I learned that even men could get breast cancer. Every bit of information I found came to the same conclusion about what the best weapon we had to fight this disease is. It is early detection.

Why did I decide to train for my 5th Olympic Games through chemotherapy and a double mastectomy? Leading with a servant’s heart caused me to want to spread this message far and wide. Fueled by compassion for others, I decided to get this message across the world’s largest media platforms:

- Pay attention to your breasts by doing self-breast exams at least once a month.

- Make sure you note any changes and bring them to your doctor’s attention immediately.

- When you come of age, schedule and keep appointments for preventative and diagnostic exams.

- Know your family history and take advantage of genetic testing that may make you aware of any hereditary risk to you or your loved ones.

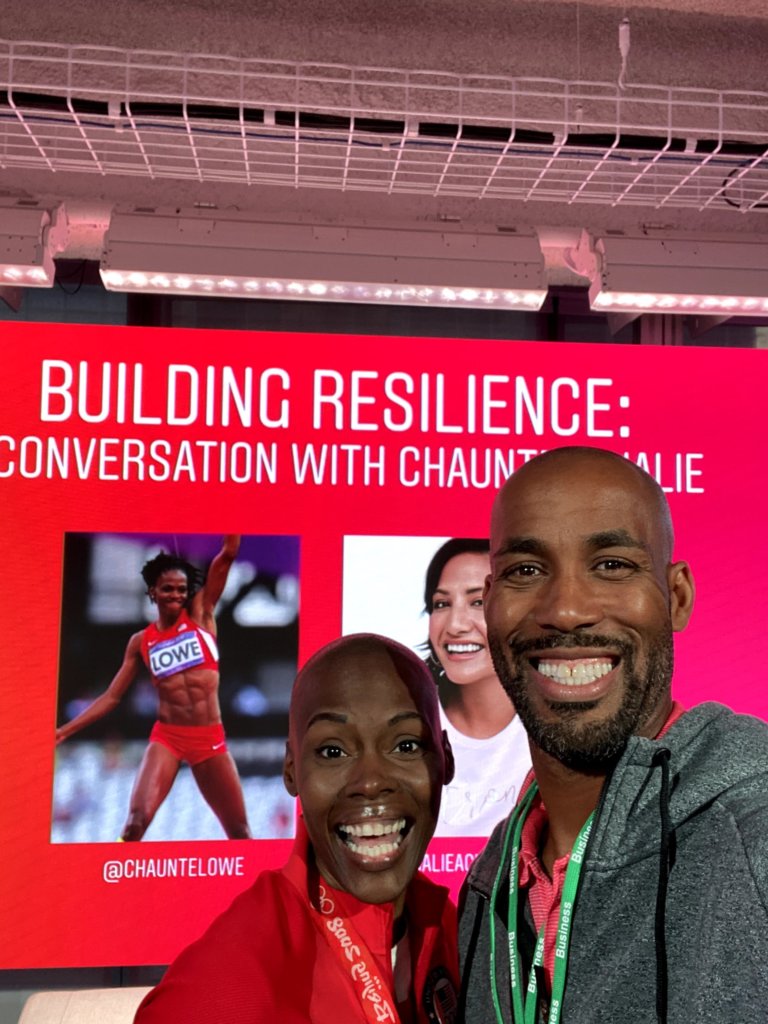

National Life Group embodies the power of expressing love to your family through love insurance, working in our communities with a servant’s heart, and caring deeply for the underserved. I am proud to see my personal values interwoven beautifully in this company’s DNA! Thank you for allowing me to share my story during this Breast Cancer Awareness Month.

Living benefits are provided by riders, which are supplemental benefits that can be added to a life insurance policy and are not suitable unless you also have a need for life insurance. Riders are optional, may require additional premium and may not be available in all states or on all products. This is not a solicitation of any specific insurance policy.

TC129455(1022)3