Are you the owner of a Pass Thru Business Entity? For instance, do you do business as a sole proprietorship, S Corporation, LLC or Partnership? If so, you may have heard that there was potentially good tax news coming from the Tax Reform and Jobs Act, passed by Congress in late 2017.

You may be able to take a 20% deduction of your qualified business income (QBI) from your personal income? I don’t want to throw cold water on this news. But there is a difference between the promise held by this deduction and the reality of the actual code section.

This new code section (IRC Section 199A) does provide for a deduction based on qualified business income (more on what QBI is shortly)–there are complex rules, thresholds, limitations and phase outs that apply.

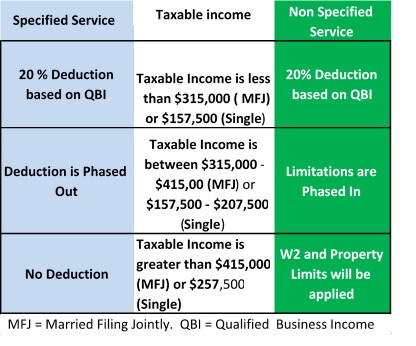

To keep this simple, here’s a chart that lays out the basics of this new deduction. Please note, the threshold issue is the classification of the business as a specified service or non specified service business. You can read the definitions of these two categories below.

The complications come in understanding the phase out formulas, the phase in limitations and getting your arms around some definitions.

First, some definitions.

Taxable Income

All taxable income included on the Taxpayer’s personal return, including spouse’s income even if spouse’s income does not come from the pass through entity.

QBI (qualified business income)

Qualified business income is the net amount of income, gain, deduction and loss from an active trade or business within the U.S. It does not include reasonable compensation paid to S corporation shareholders, any guaranteed payments or to the extent provided in regulations, payments to a partner for services under IRC Section 707(a). Qualified business income is determined on a per business basis. Qualified business income includes REIT dividends and qualified coop dividends.

W-2

Wages Paid to Employees. It includes all W2 wages paid including amounts paid to owner/employees.

Qualified Property

Qualified property is tangible property (property you can touch) used to produce qualified business income.

Specified service trade or business

A specified service trade or business is a business or trade where the principal asset of such trade or business is the reputation and skill of one or more of its employees. Types of businesses or trades included in this definition are health, law, consulting, athletics, financial services and brokerage services. Think of it this way, if the success of your business depends on you and not something you sell, you are included in this definition. Architect and Engineer services are considered a non-specified service or trade business and are excluded from this definition.

With the help of these definitions you can start identifying where you fall in the chart. For instance, if you are married, filing jointly and you total family income is less than $315,000 – then the 20% deduction will be available to you.

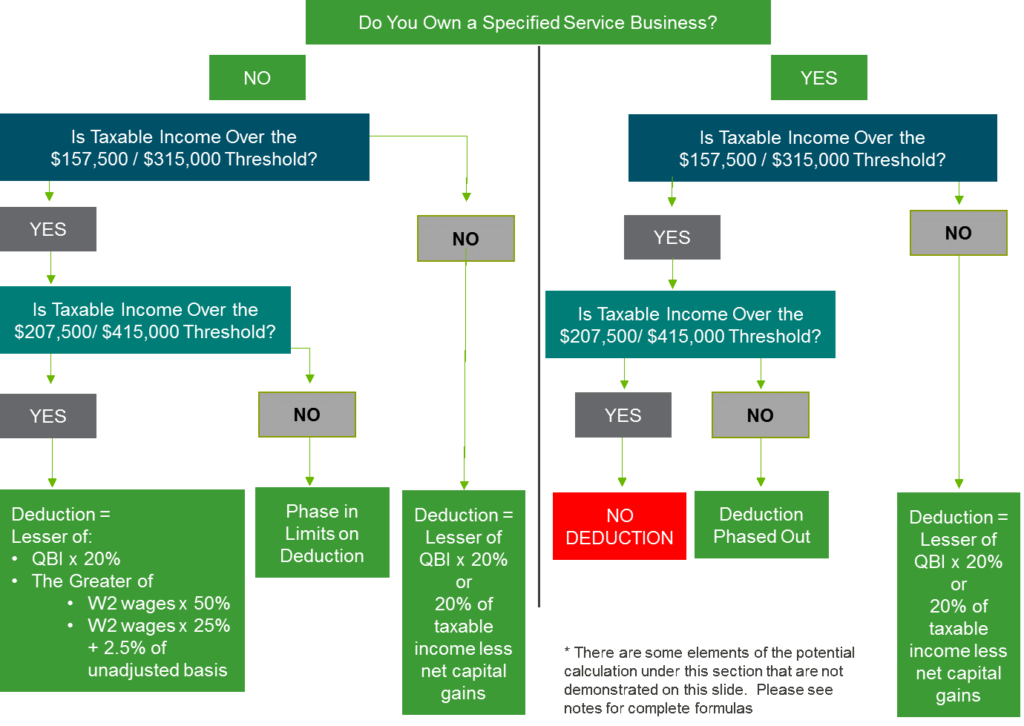

At this point, it may also be helpful for you to see some additional detail. Here’s a flow chart that demonstrates some of the basics of the concept and also includes some of the pertinent formulas.

You can use this flow chart to get a better sense of whether the deduction will be available to you or whether there are limitations or a phase out will be applied.

Let’s look at a few examples

Example 1

Susan owns a Healthcare Clinic and is married to Jim and they are filing jointly. Together their taxable income is $300,000 and they have no net capital gains. Susan has qualified business income of $200,000. The Health Care Clinic does not pay anyone (including Susan) W-2 wages. What is their deduction?

Let us look at the flow chart above. Does Susan own a specified trade or business? Yes, a healthcare service falls within the IRS’ definition. Is taxable income more than $315,000 (married filing jointly)? No, taxable income is $300,000.

Susan and Jim qualify for the 20% deduction on her qualified business income. Their deduction is $40,000 ($200,000 QBI X 20%= $40,000)

Example 2

Fred owns a non-specified service business and has qualified business income of $500,000 and taxable income of $500,000. Fred does not have any W-2 and does not have any W2 employees. Fred is married and files taxes jointly with his spouse. What is Fred’s 199A deduction?

Let us look at the flow chart and do the analysis. Does Fred own a service or trade business? The answer is NO. Is Fred’s taxable income over $315,000 Filing jointly? Yes, it is $500,000. Is taxable income over $415,000? Yes.

Fred’s deduction is the lesser of QBI x 20% or the greater of W-2 x 50% or W-2 x 25% plus 2.5% of unadjusted basis. Fred’s 199A deduction is $0.

How did we get $0? Start with the calculations. First $500,000(QBI) X 20%= $100,000. Second, calculate out the greater or $0 (W-2) X 50%= 0 or $0(W-2) X 25% plus 2.5% of unadjusted basis ($0). The formula provides that the deduction is the lesser of these two parts of the formula. 0 is less than $100,000 so Fred gets 0 deduction.

Example 3

Same scenario as above except Fred has $500,000 of taxable income and qualified business income of $400,000 and W-2 wages of $100,000. What is Fred’s 199A tax deduction?

Fred’s taxable income is above the $415,000 threshold so the formula to determine Fred’s deduction is still the same, lesser of QBI X 20% or the greater of W-2 x 50% or W-2 x 25% plus 2.5% of unadjusted basis. Let us do the math:

$400,000(QBI) X 20%=$80,000 0r the lesser of the greater $100,000(W-2) X50%=$50,000 or $100,000 (W-2) X 25%=$25,000 plus 2.5% of unadjusted basis $0=$25,000. Fred, deduction would be $50,000.

It paid to have w-2!

Conclusion–at least for today

It is important to note that the 199A deduction sunsets December 31, 2025.

There will be much more to come on this deduction as time passes and the IRS issues guidance. In the meantime, clients will be asking a lot of questions. Should I incorporate as a C corporation or a pass-thru? Is there any advantage to setting up a C Corporation alongside my pass-thru entity? Can I plan in such a way that that I can qualify for a 199A deduction?

As you can well imagine, the answers to all these questions will depend on each business owner’s individual circumstance. It will be important for business owners’ to work closely with their legal, tax and financial advisors to determine what is best for them in applying this new and complex code section.

IRS CIRCULAR 230 REQUIRES US TO INFORM YOU THAT THE ABOVE INFORMATION IS NOT INTENDED OR WRITTEN TO BE USED, AND IT CANNOT BE USED, BY ANY PERSON FOR THE PURPOSES OF AVOIDING ANY PENALTY THAT MAY BE IMPOSED BY THE INTERNAL REVENUE SERVICE.

In the event the advice is also considered to be a “marketed opinion” within the meaning of the IRS guidance, then as required by the IRS, please be further advised of the following:

THE ABOVE ADVICE WAS WRITTEN TO SUPPORT THE PROMOTION OR MARKETING OF THE TRANSACTIONS OR MATTERS ADDRESSED BY THE WRITTEN ADVICE AND, BASED ON THE PARTICULAR CIRCUMSTANCES, YOU SHOULD SEEK ADVICE FROM AN INDEPENDENT TAX ADVISOR.

Matt Ryan contributed to this article.

TC99509(0218)1