Diana Greenberg is a titan of the life insurance industry. Diana has tirelessly been moving mountains since she entered the family business at just 19 years old. She is well-known and sought after for her skills and chairs many industry boards to help revolutionize the industry. Diana is a true servant-leader; she never misses an opportunity to pave a path for her employees or her agents and she will always be the first person at the finish line to help them celebrate their successes.

What has your career pathway been like? How did you get to where you are now?

My Career was determined at a very early time in my life considering my parents had established our company in 1971 when we first moved to Los Angeles. I spent most nights listening to them talk about work when I was a teenager. My parents had created an agency early on that was known for assisting agents with substandard business or clients with high net worth including much of the entertainment and sports world.

You could say I was trained by the best. My father was responsible for sales and mother was in charge of operations for the company they founded in 1971 when we first moved to Los Angeles. By the time I was 19, I was running our new business & underwriting department, which truly began my journey. At 21, I was already visiting Insurance carriers and assisting them by advising on the best way for new business to be tracked and handled in a more efficient manner. Over the years, I became known for my skill set with new business operations and my ability to underwrite a case and negotiate on behalf of our agents.

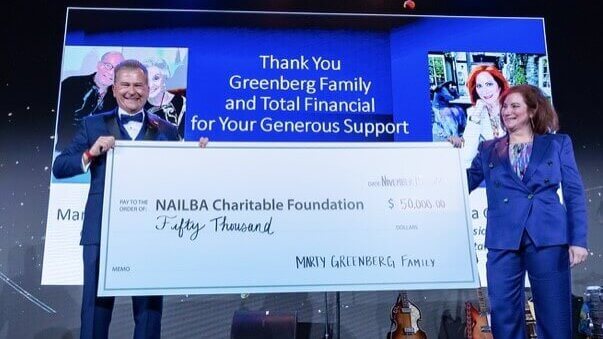

I have worked at Total Financial for 38 years. I have done every job in this agency, which allows me to give advice or have knowledge about all areas of our business. Through the years, I have been asked to participate on many boards for various different insurance companies because of this knowledge. I have always been and always will be dedicated to helping our industry grow and improve services which is why I participate on various boards.

In 2013, I became President and CEO of Total Financial. I believe it was my task to take Total on a different path than it had been for many years since our industry was changing. Technology was advancing and being used more and more. I quickly realized how to market and started taking advantage of the social media platforms and hosting webinars and podcasts.

I have been known in our business to be a woman who keeps her word, helps others, and has a very good ability to examine a case and negotiate for the best offers. Relationships are probably one of the most important things to have in order to be successful in this business, so it has always been a priority. I will continue to support our industry and consult with others regarding any platform. Our agents know that I am available to discuss a case or an idea 24/7 and that has made me very accessible and successful. Today, Total Financial is one of the top leading General Agencies in the country. We have agents all over the United States who choose to do business with us.

What do you like most about working with the National Life Group?

National Life has been a company that has been around for many years. They have been a company to rely on. They offered excellent products with living benefits before many others. What stands out the most to me is how the employees are treated and the message that is conveyed to the public of who they are and what they support. They support diversity, women, and many worthwhile initiatives.

Has the industry landscape changed during your career? What have you seen?

The industry landscape has totally changed over my career. Regretfully, we do not have enough new agents who are entering the profession. The agents that did sell a lot of insurance have since retired. We are dealing with a much younger market. Clients are buying insurance at earlier ages. Even the way we communicate is different. We use email for most communication and now we are even beginning to use text messaging. Marketing is done digitally. Videos are used much more for educating and messaging. Different products emerged and the importance of long term care and chronic illness became a conversation with every sale.

Is there a particular woman who has inspired you in life?

My biggest inspiration from the beginning was my mother. At a time when there were not many women in our industry, she was well known and respected. Through the years, relationships with many different female underwriters have inspired me to be the best at my craft. There were also a few other females who were presidents of their own insurance agencies that have inspired me through the years.

What advice would you give to young women who are just beginning their careers?

Believe in yourself and your knowledge. Go after whatever you want to do and be the best at it. Don’t let other people get in your way. Come from a place of strength and confidence when speaking.

What leadership quality do you most admire and aspire to?

Always be open to discuss anything with your employees or peers. Be able to mentor others and educate them.

Any other words of wisdom you’d like to share?

Change is a good thing. Accept it. Be flexible and adapt. Never settle for status quo. Sometimes being a disrupter is a good thing.

TC133090(0423)3